TRADING EXCHANGE-TRADED FUNDS (ETFs)

One of the most popular and lucrative strategies for diversifying products is through expanding into various markets, sectors, currencies, and commodities.

Advantages of Trading ETF Derivatives with QCG

Wide Variety of Exchange-Traded Funds (ETFs) from Different Parts of the World.

Cost Efficiency Due to Low Transaction Costs.

Diversification as a Risk Management Strategy.

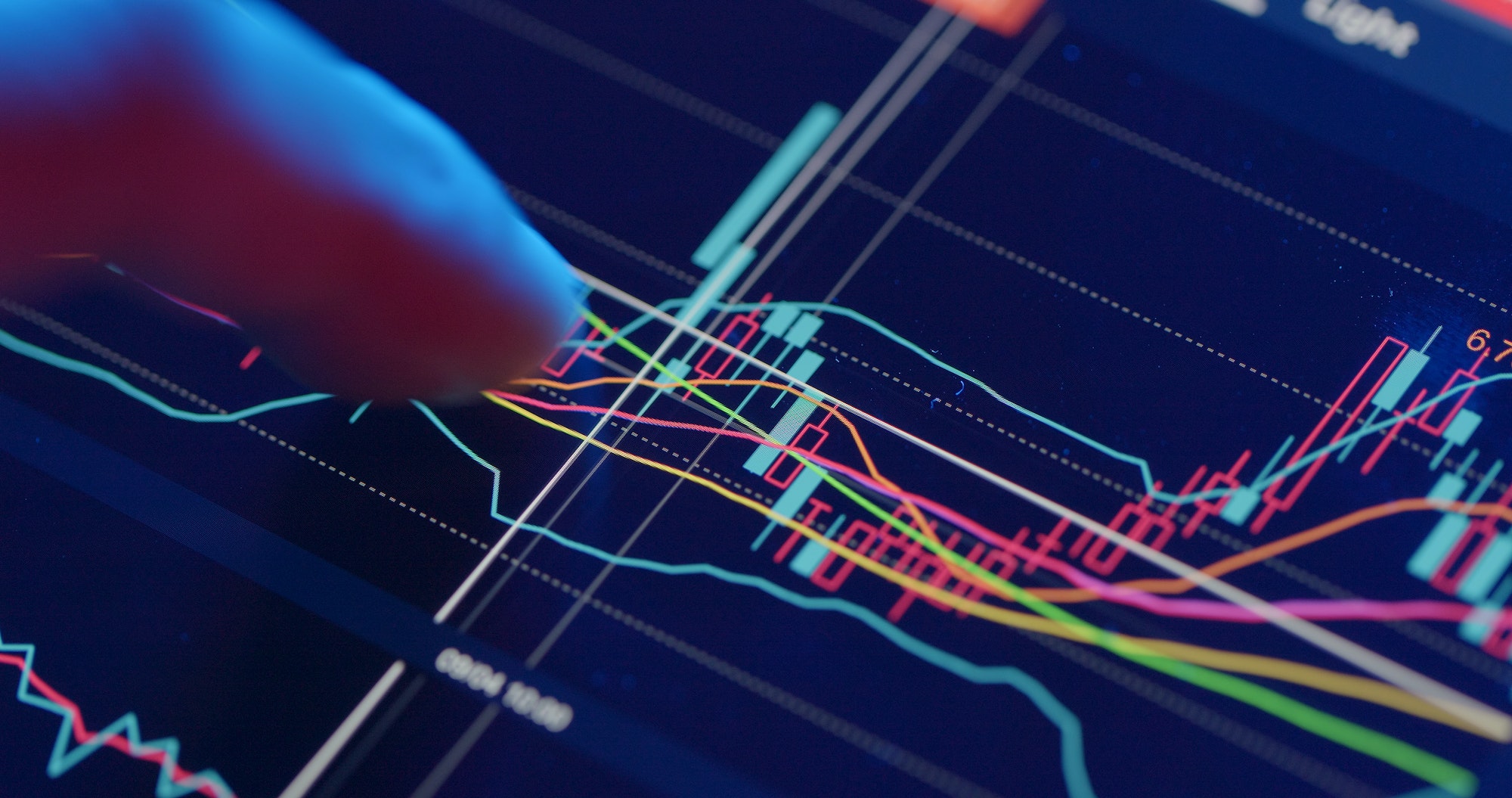

The ETF Market

The ETF market, or Exchange-Traded Funds, refers to the financial space where exchange-traded investment funds are traded. These funds are designed to replicate the performance of an index, sector, commodity, or other underlying asset. ETFs offer investors the opportunity to diversify their investment portfolio by providing exposure to a broad set of assets with a single investment.

The advantage of trading with ETFs lies in several features. Firstly, ETFs allow for greater liquidity as they are traded on exchanges much like stocks, meaning investors can buy and sell shares at any time during trading hours. Additionally, by replicating the performance of an index or underlying asset, ETFs provide an efficient and cost-effective way to diversify a portfolio, reducing the risk associated with investing in individual assets. They also offer transparency, as investors can track the real-time value of their holdings and the composition of the ETF’s portfolio.

Another advantage of trading with ETFs is flexibility, as they enable investors to take both long and short positions, meaning they can benefit from both rising and falling markets. Moreover, ETFs often have lower operating costs compared to other traditional investment funds, making them an attractive option for those seeking efficient and low-cost investments.

At QCG Markets, we offer a wide variety of ETFs, allowing investors to take advantage of these benefits and build a diversified and well-balanced portfolio.

Complete List of ETFs you can trade on QCG Markets

Important Information for the ETFs Market

Spreads are variable and provided by the respective exchange. Swap values may be adjusted monthly based on market conditions and are applicable to all open positions. Triple swaps apply on Fridays. Server time: winter: GMT+2 and summer: GMT+3 (Daylight Saving Time) (last Sunday of March until last Sunday of October).

A commission fee per lot will be applied at both opening and closing, depending on the account type.

Calculation of shared margin requirements – Example:

- Account base currency: EUR

- EURUSD market price: 1.12835

- Position: Open 3 lots BUY IXN at 235.60

- Lot size: 1 share

- Margin required: 20% of notional value

- The notional value is: 3 * 1 * 235.60 = 706.80 USD

- Margin required is: 706.80 USD * 0.20 = 141.36 USD = 125.28 EUR.